Better Small Business Lending Requires Better Data

Stories and studies have long demonstrated disparities in small business lending, particularly for minority- and women-owned businesses, but we lack the data to quantify these disparities and hold lenders accountable. Small business data must be made public.

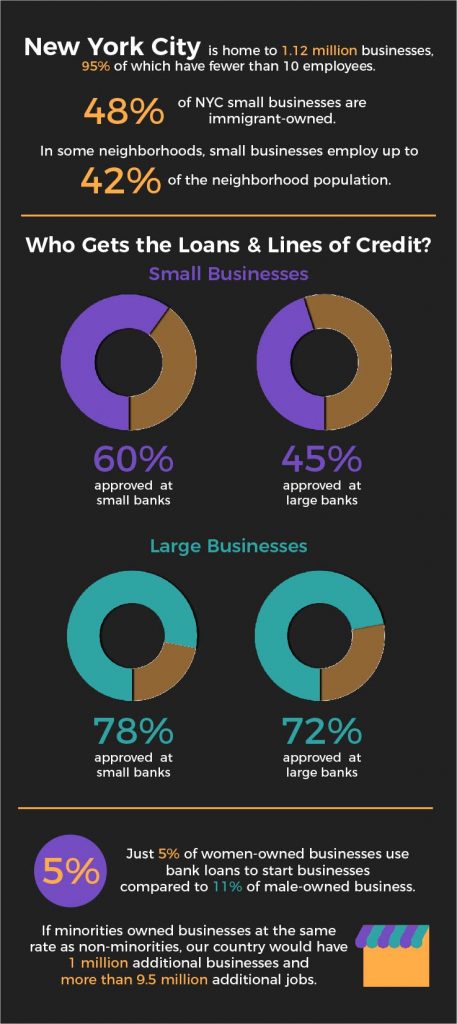

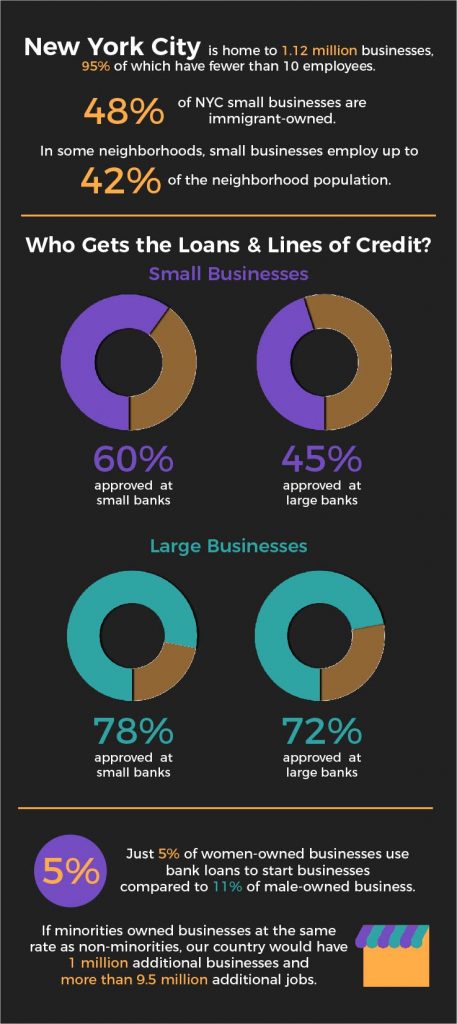

New York City is home to 1.12 million businesses, 95% of which have fewer than 10 employees; in fact, over 883,000 have no employees and are operated solely by the owner. As of 2012, 39% were women-owned businesses and 51% minority-owned. Additionally, 48% of New York City small businesses are immigrant-owned, and in some neighborhoods, small businesses employ up to 42% of the neighborhood population. Yet, we know virtually nothing about their ability to access financing to start, maintain, and grow their businesses.

Access to capital is critical for these small businesses to grow, yet they continue to face barriers in accessing financing from traditional banks. As a result, they are often forced to borrow from friends and family; use personal savings; defer investment; or turn to less-regulated, higher cost, sometimes predatory online lenders.

Access to capital is critical for these small businesses to grow, yet they continue to face barriers in accessing financing from traditional banks. As a result, they are often forced to borrow from friends and family; use personal savings; defer investment; or turn to less-regulated, higher cost, sometimes predatory online lenders.

For decades, the Home Mortgage Disclosure Act (HMDA) has helped reveal disparities and identify credit needs in residential home lending to low-income and minority people and communities. Unfortunately, we do not have a similar set of data for small business lending. Currently, only large banks are required to report small business lending, and the data they report is extremely limited, with little information about the size of the business and no other important details, such as the demographics of the owners, types and costs of loans, or denial rates. And small banks and non-banks don’t report at all. Section 1071 of Dodd Frank was designed to address this – to provide the public with a wide range of small business lending data, including business size, owner demographics, types of loans, and approval rates. Yet, before it has even gone into effect, lenders are opposing it. We urge the CFPB and Congress to ensure that the small business reporting mandated by Section 1071 is fully implemented.

In lieu of comprehensive data, we now rely upon surveys and stories that document the disparities and the need for better data. None of these provide lender details. For years now, a set of Federal Reserve Boards has been conducting a study of small business credit needs to identify trends and barriers to financing. Not surprisingly, approval rates are lower for smaller businesses. In 2016, 60% of small businesses with revenue under $1 million were approved for loans and lines of credit at small banks and 45% at large banks, versus 78% and 72%, respectively, for large businesses. They also highlight the challenges businesses face in accessing financing from the online lenders. Small businesses were much more likely to use these lenders and all businesses reported them to be higher cost and less transparent than banks and CDFIs. Another study about the online lending market found that the average alternative loan carried an annual percentage rate (APR) of 94%. Among Hispanic borrowers, they found that their average monthly payment was more than 400% of their take-home pay. Section 1071 is a critical tool to expose the details of their lending, which is now completely hidden.

Several other studies have documented the challenges small businesses, particularly those that are women-owned and minority-owned, face in accessing credit. One study showed that just 5% of women-owned businesses use bank loans to start their businesses compared to 11% of male-owned businesses. If minorities owned businesses at the same rate as non-minorities, our country would have 1 million additional businesses and more than 9.5 million additional jobs.

ANHD members who work with small businesses tell similar stories of borrowers – particularly immigrant owned businesses and minority- and women-owned businesses – who struggle to access financing to start, maintain, and grow their businesses.

Without good data, we cannot effectively document disparities in the lending market or hold lenders accountable for disparate lending. Without good data, we cannot identify unmet credit needs. Comprehensive data such as the data collected under 1071 is essential to increasing access to credit for small businesses, particularly those in lower-income tracts and owned by lower-income people, people of color, and immigrants.

The CFPB is collecting comments on 1071 through September 14th.We must tell show our support! Contact ANHD if you’d like sample comments you can submit – it’s simple, fast, and important.

Jaime Weisberg, ANHD’s Senior Campaign Analyst

Today, community groups, legal service providers, and the Department of Small Business Services (SBS) launched the Commercial Lease Assistance Program, a new effort to address the power imbalance between commercial tenants and the landlords who exploit them by providing small businesses with legal services on leasing. The new program serves as a crucial extension of the policy advanced by United for Small Business NYC (USBNYC), the Commercial Tenant Anti-Harassment Law. USBNYC members Brooklyn Legal Services Corporation A, Chhaya CDC, Cooper Square Committee, Cypress Hills Development Corporation, Northwest Bronx Community and Clergy Coalition (NWBCCC), Urban Justice Center, and Volunteers of Legal Service will work alongside African Communities Together and Pan-African Community Development Initiative to connect small business owners with legal service providers who can inform them of their rights.

Today, community groups, legal service providers, and the Department of Small Business Services (SBS) launched the Commercial Lease Assistance Program, a new effort to address the power imbalance between commercial tenants and the landlords who exploit them by providing small businesses with legal services on leasing. The new program serves as a crucial extension of the policy advanced by United for Small Business NYC (USBNYC), the Commercial Tenant Anti-Harassment Law. USBNYC members Brooklyn Legal Services Corporation A, Chhaya CDC, Cooper Square Committee, Cypress Hills Development Corporation, Northwest Bronx Community and Clergy Coalition (NWBCCC), Urban Justice Center, and Volunteers of Legal Service will work alongside African Communities Together and Pan-African Community Development Initiative to connect small business owners with legal service providers who can inform them of their rights. Small businesses are a central component to New York City’s economic and cultural vitality. However, they have historically lacked the protections needed to protect them from unscrupulous landlords. Working with Councilmember Robert Cornegy, United for Small Business NYC members successfully ensured the passage of the Commercial Tenant Anti-Harassment Law in 2016. While the law, the first of its kind in the nation, defined commercial tenant harassment and established a private right of action for commercial tenants experiencing harassment, it lacked funding for legal services to educate and inform business owners of their rights.

Small businesses are a central component to New York City’s economic and cultural vitality. However, they have historically lacked the protections needed to protect them from unscrupulous landlords. Working with Councilmember Robert Cornegy, United for Small Business NYC members successfully ensured the passage of the Commercial Tenant Anti-Harassment Law in 2016. While the law, the first of its kind in the nation, defined commercial tenant harassment and established a private right of action for commercial tenants experiencing harassment, it lacked funding for legal services to educate and inform business owners of their rights. ANHD 2016 Building the Community Development Movement

ANHD 2016 Building the Community Development Movement