The “Bad Boy” Carveout

What the Attorney General’s Court Filing Says About Signature Bank, Madison Realty Capital, and the Business of Tenant Harassment

There has been a growing drumbeat of public criticism of tenant harassment in buildings with mortgage loans from Signature Bank, culminating last month in a tenant picket in front of Signature Banks’s Annual Investors Conference. Tenants have been telling the bank and the media that the harassment they are experiencing is both severe and intentional and that the bank should be aware of the damage their lending is enabling.

Now, a new court filing by New York State Attorney General Eric Schneiderman has exposed subpoenaed documents that appear to validate the tenants’ concerns: Signature Bank and Madison Realty Capital underwrote loans where the cost of the debt-service payments were far higher than the landlord could afford unless he kicked out the low-rent paying tenants. In fact, the landlord had an explicit plan that was understood by the lenders to do just that.

While tenants have raised concerns about a number of different buildings with Signature Bank loans (Read the letter tenants delivered to Signature’s board), the Attorney General’s filing focused on a portfolio of 15 rent-stabilized buildings in the Lower East Side that were purchased in 2015 by the now notorious Raphael Toledano. The Attorney General’s May 15th filing focused primarily on the role of the primary lender on the buildings, a non-bank lender called Madison Realty Capital, objecting to a proposed bankruptcy order involving the Toledano buildings.

The Attorney General argued that internal, subpoenaed documents show that Madison Realty Capital was engaged in a predatory “loan to own” scheme that was both financially irresponsible and designed to displace rent-stabilized tenants. Ultimately, the buildings fell into foreclosure when Toledano was unable to pay his debts to Madison Realty Capital. The Toledano-related entities that own these 15 buildings subsequently filed for bankruptcy and worked out an agreement that would allow Madison Realty Capital’s management arm, Silverstone Property Group, to manage the buildings during the bankruptcy. The Attorney General argues that Madison Realty Capital’s predatory scheme leaves them with “unclean hands”, and that the proposed bankruptcy order would unfairly allow them to maximize their own profits at the expense of the tenants and other unsecured creditors. The bankruptcy judge nonetheless disregarded the Attorney General’s objections and adopted the proposed order. While we are disappointed by this decision as a technical matter in the bankruptcy case, it does not change the underlying facts that were revealed in the AG’s filing about the lenders’ predatory approach.

The subpoenaed documents and the Attorney General’s filing clearly suggest that Signature Bank also has “unclean hands”.

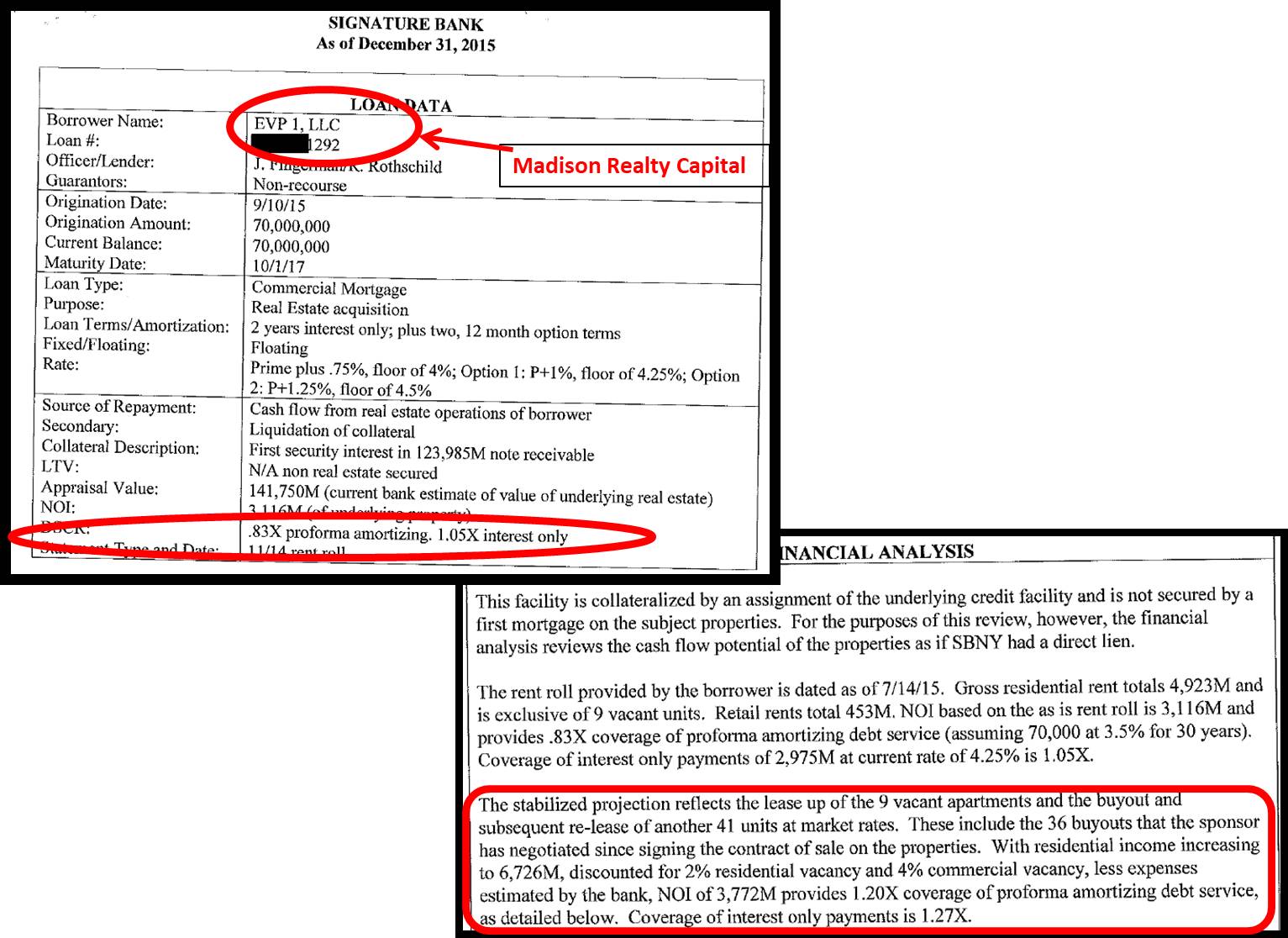

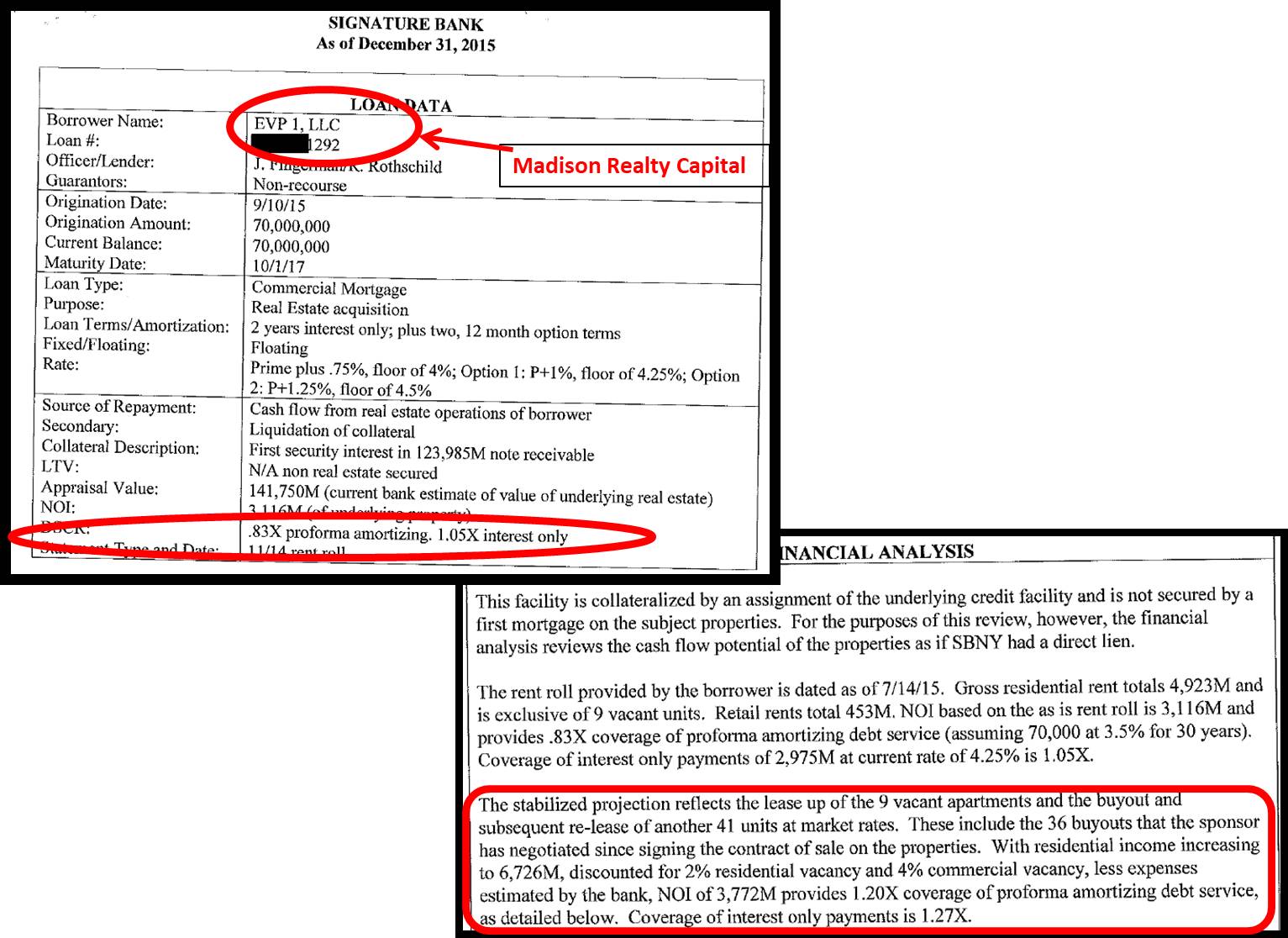

On the same day that Madison Realty Capital originated their loan to Toledano, Signature issued a loan to Madison Realty Capital with this same building portfolio used as collateral. The Signature Bank Loan data file makes clear that Signature Bank was complicit with Madison through their collateral loan “to provide capital for funding of the underlying loan,” together financing Toledano’s plan to displace and remove long-term tenants.

Rent-regulated multifamily housing is one of the most important sources of affordable housing in the city, but our City is losing rent-regulated housing at an alarming rate, with over 156,000 units of rent-regulated housing lost from 2007 to 2014 alone. Too often, unscrupulous landlords, like Toledano, use illegal and semi-legal tactics to push out low-rent paying tenants so they can take advantage of loopholes in rent-regulation to dramatically increase rents. In fact, the Attorney General filing describes the harassment tactics the Toledano Tenants Coalition has been reporting for years: aggressive, fraudulent, and improper buyout offers; frivolous lawsuits; and unlawful, hazardous renovations that resulted in losses of essential services and elevated lead levels. They also note that some of the “market-rate” apartments targeted to vacate may have been improperly removed from the rent-stabilization system.

Lenders should not be enabling this growing crisis with bad lending, but Signature Bank did exactly that.

ANHD has a set of common-sense best practices for responsible multifamily lending, but Signature Bank has rejected the need to follow them. The Toledano deal illustrates what can happen to low- and moderate-income New Yorkers when these guidelines are not followed.

- Best Practice #1: Lenders should underwrite to a minimum Debt Service Coverage Ratio of 1.2, based on current, in-place rents and realistic maintenance costs.

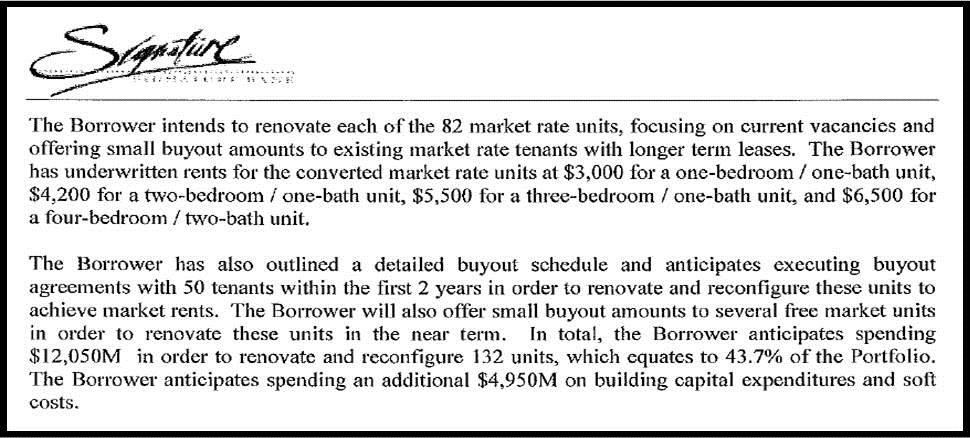

But, Signature and Madison underwrote the loans to a Debt Service Coverage Ratio of 0.83, meaning that Toledano would only have 83 cents in income for every $1 in debt he owed, unless and until he could rapidly increase the income, presumably by pushing out low-rent paying tenants. In fact, Signature Bank’s underwriting report explains that the Debt Service Coverage would rise to 1.27 when 41 rent-regulated tenants accepted buyouts, nine vacant units were occupied, and extensive renovations were completed.

One of the four mortgages Madison Realty Capital issued Toledano required him to spend $2 million of the loan exclusively on tenant buyouts or renovations. And the Attorney General filings revealed that a $4.3 million mortgage was specifically for tenant buyout payments and other “soft costs.”

From Pages 1 and 3 of the Signature Bank Loan Data File:

- Best Practice #2: Lenders should ensure realistic appraisal values, based on current rents, building conditions, and maintenance costs.

But, both Signature and Madison’s loan documents demonstrated that the Net Operating Income (NOI) was insufficient to cover just the interest payments on the loans and there was virtually no way he could pay off the loans within the two year term. The Attorney General asserts “Toledano and Madison’s Impossible ‘Plan’ for Increasing Property Values Relied on Unlawful Conduct and Tenant Harassment”.

Madison’s plan from the outset assumed that the Debtors would engage in unlawful conduct in an effort to meet Madison’s loan terms. The Debtors’ unlawful conduct – including, but not limited to, illegal and unsafe construction; tenant harassment; and the failure to operate these properties properly for tenants who chose not to vacate – was a consequence of these unaffordable loan terms. [Paragraph #79 of AG’s Objection to Final Consent Order]

From Signature Bank Corporate Credit Offering Memorandum:

Signature files reveal that the bank knows and trusts Madison’s business model and had no problem supporting them in making these loans. In fact, this led them to lower the risk assessment in relation to this particular loan.

According to the HPD’s analysis, the parties overvalued the properties and drastically underestimated the maintenance costs. In fact, HPD estimated that the true maintenance costs would be four times the amount in the loan documents. [Paragraph #45 of AG’s Objection to Final Consent Order] The filing also noted that the planned renovations to add bedrooms and drive up the prices included illegal bedrooms that would be too small and lack required windows.

Signature Bank, for example, has engaged in numerous transactions with Madison, including by purchasing a $70 million share of Madison’s debt on the East Village Portfolio. According to internal documents provided to the NYAG, Signature agreed to accept Madison’s loan to Toledano as collateral for its own $70 million loan to Madison, in part because Signature recognized that Madison “would have no problem foreclosing and or owning” the Portfolio when the loan to Toledano entered into default. … Signature also observed that Madison had significant experience with the type of scheme proposed by this deal, and that with many of the buildings Madison owned it had “purchased the buildings, gut renovated units and re-leased them at substantially higher rents.” [Paragraph #32 of AG’s Objection to Final Consent Order]

- Best Practice #3: Lenders should consult multiple sources to evaluate the record of landlords and property managers, including their record of managing properties that are not within the bank’s portfolio.

Toledano’s background check should have raised major red flags for any potential lender. He is a convicted felon and known for fraudulent behavior. He had very little experience as a property manager and one of his first deals led him to pay a reported $1 million settlement for harassment of tenants. Rather than turn the lenders away, Madison and Signature loaned him $124 million and Madison gave Toledano another $1.1 million mortgage to pay this settlement. [See Paragraph #37 of AG’s Objection to Final Consent Order]

In fact, Signature Bank’s underwriting documents refer to their “standard recourse ‘bad boy’ carveouts” in the loan documents. While the term is especially poetic, this may actually be a relatively standard mortgage clause. But, if Raphael Toledano doesn’t trigger the “bad boy’ clause, who does?

ANHD also recommends that banks hold regular information sessions with tenant organizers, hire a point person to meet with tenants and organizers when problems arise, take proactive steps to address issues in buildings, and decline to make loans that don’t meet the above criteria. Banks should also participate in a “first look” program to transfer buildings with distressed loans to responsible preservation-minded developers.

Lenders must be held accountable, especially bank lenders like Signature Bank that are covered by the Community Reinvestment Act (CRA). Under the CRA, banks can get community development credit for multifamily loans where the rents are affordable to lower-income tenants. At the same time, most regulators will not give credit if the buildings are in bad condition or if the loans lead to displacement or a loss of affordable housing, as was the case with Toledano’s portfolio. Banks should uphold both the letter and the spirit of the CRA by ensuring the loans they make and the loans they use as collateral uphold these standards to preserve affordable housing and protect tenant’s rights. ANHD urges Signature to commit to these best practices.

Likewise, non-bank lenders like Madison are not licensed by the New York State Department of Financial Services and are not covered by the CRA. ANHD believes that regulators should explore how they can license and regulate non-bank lenders in order to create protections for tenants in buildings they finance.

ANHD 2016 Building the Community Development Movement

ANHD 2016 Building the Community Development Movement