Albany 421a Deal May Mortgage NYC’s Future for Bigger REBNY Tax Break

New Evidence Suggests that the Exemption May Not Have Any Public Benefit

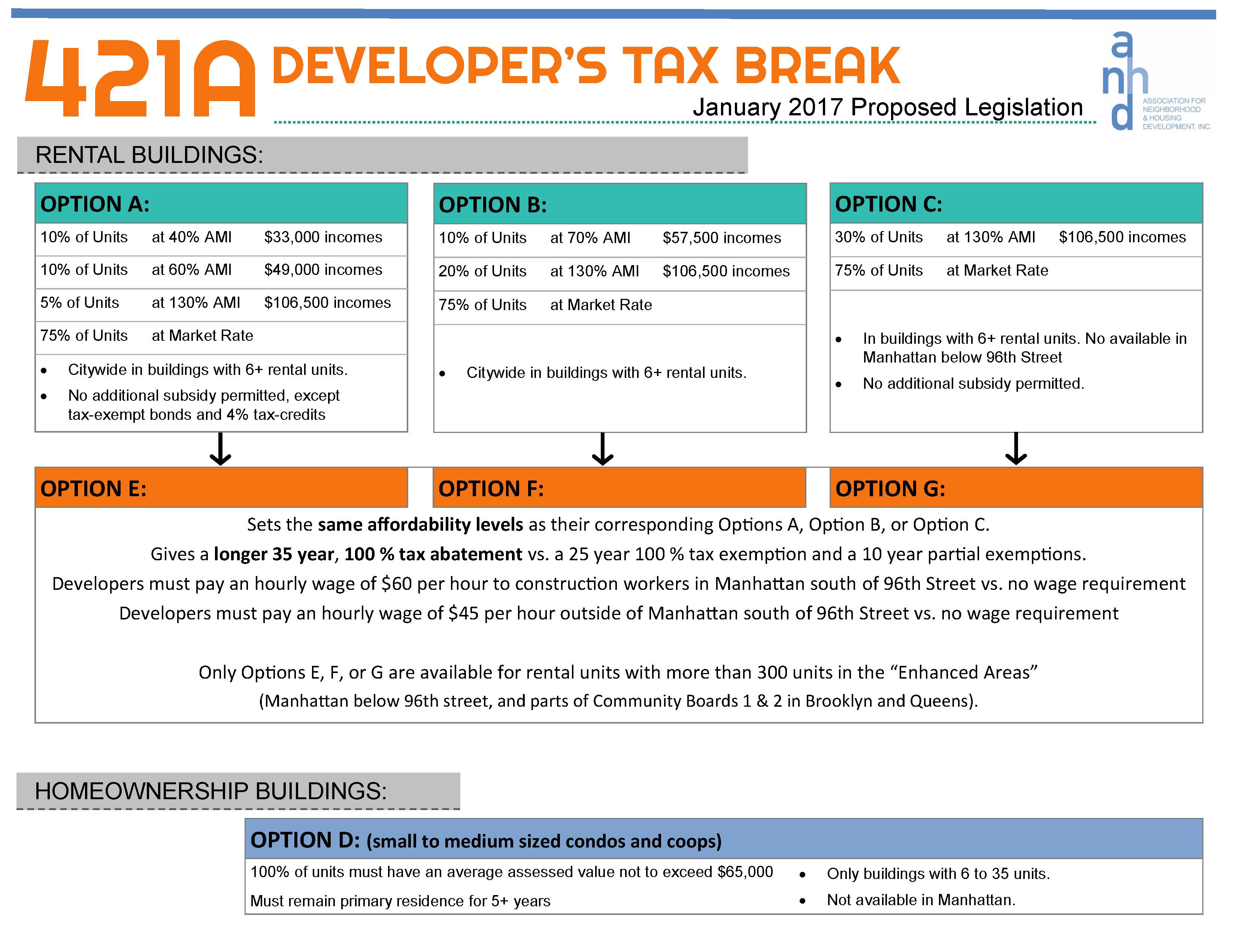

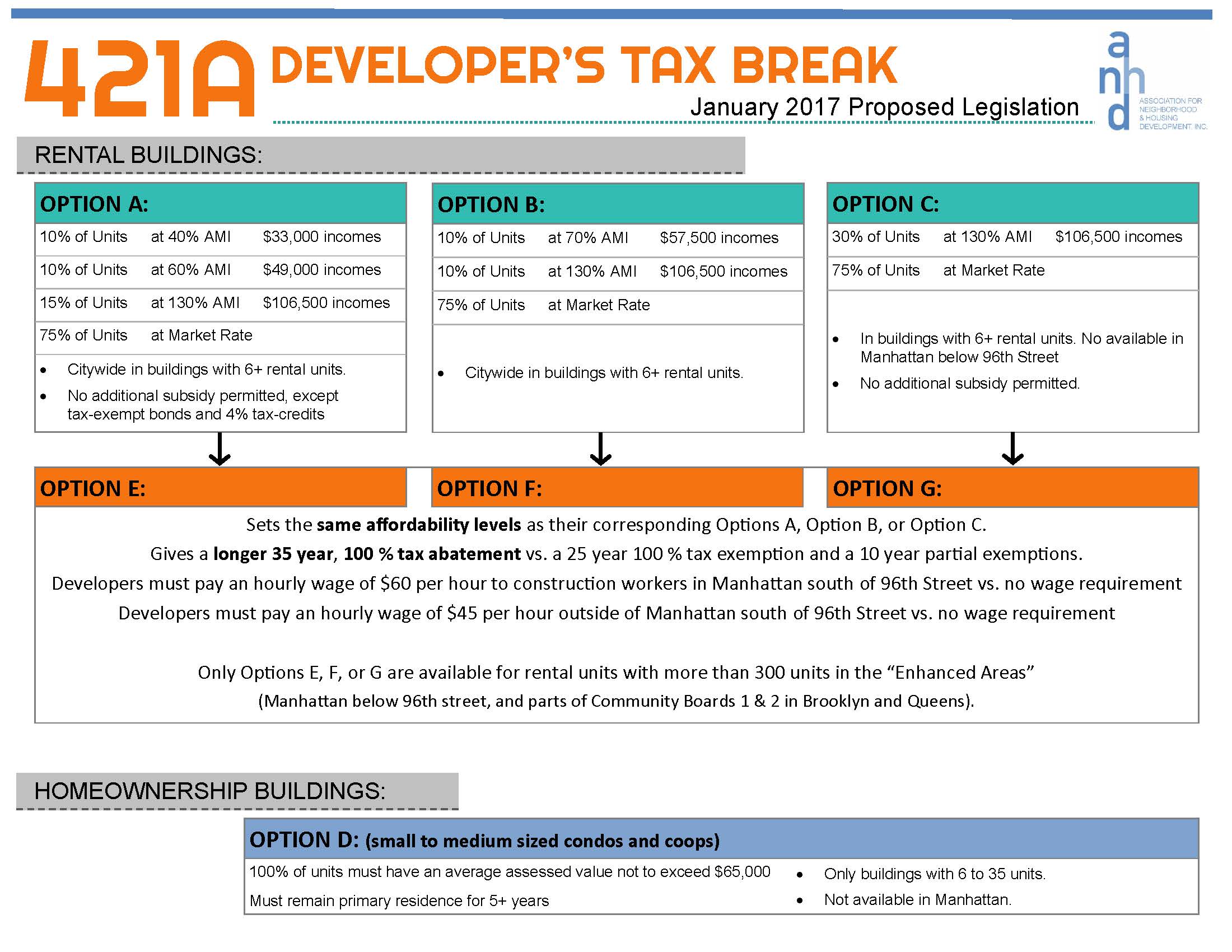

The controversial 421a tax exemption for developers – now popularly known as the Trump Tax Break – is back in the news with reports of a possible pre-Election Day deal that would mortgage New York City’s budget for decades to come.

As a recent article in Politico New York reports, decision-makers are not only conferring to bring the 421a Trump Tax Break back, but they are also considering making the tax break even more costly by extending the term of the exemption. This would give private developers up to 45 years of paying no property taxes – 10 years longer than the law that expired in January and 20 years on top of an earlier version – all at the expense of New York City taxpayers. This would give private developers up to 45 years of paying no property taxes – 10 years longer than the law that expired in January and 20 years on top of an earlier version – all at the expense of New York City taxpayers.

The new 421a proposal is unconscionable on its face. Our NYC classrooms need supplies and 21st technology; our roads, bridges, and mass transit need investment and repair; and our nurses and firefighters need paychecks.

With at least a $3 Billion City budget deficit by 2019 just around the corner, we cannot afford to mortgage our City’s fiscal future in exchange for a tax break for private developers to create primarily market-rate housing. It is unconscionable that the ability of New York City to pay for essential government services for its citizens for the next 45 years might be mortgaged away and handed over to REBNY as a pawn in the negotiations between the real estate lobby and the building trade unions to revive the 421a Trump Tax Break. With at least a $3 Billion City budget deficit by 2019 just around the corner, we cannot afford to mortgage our City’s fiscal future in exchange for a tax break for private developers to create primarily market-rate housing.

The cost of the 421a Trump Tax Break to our City is dramatic and increasingly indefensible. A 2015 analysis of the exemption by ANHD shows that in fiscal year 2013-14, the 421a program covered a total of 152,402 residential units, and granted $1.1 billion in tax abatements. But, only 12,748 of those units had affordability restrictions. That translates very roughly to about $86,000 a year that taxpayers are transferring to private developers to subsidize each affordable unit, making 421a tax break by far the most inefficient affordable housing program on the books.

This 421a Trump Tax Break deal will hand a hefty portion of the City’s tax base over to REBNY. The fact that these negotiations are happening under the shadow of Election Day coverage and between the real estate industry, the build trades, and without any conversation on rent regulation or with affordable housing stakeholders make it all the egregious.

And evidence is mounting that the 421a Trump Tax Break may not even accomplish the most minimum public purpose.

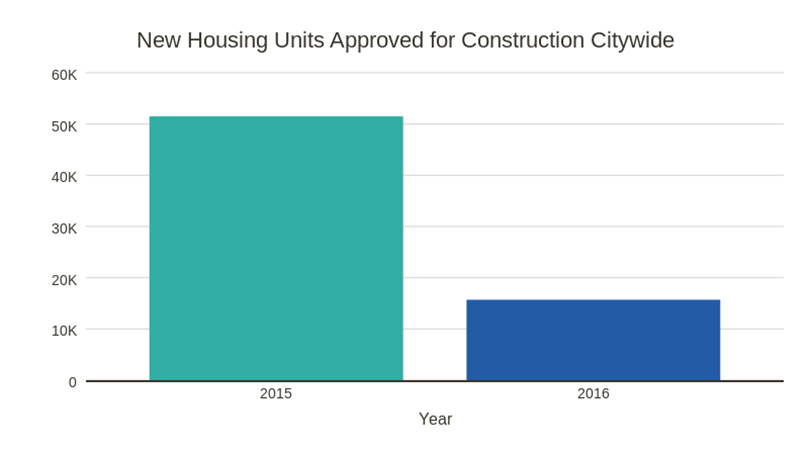

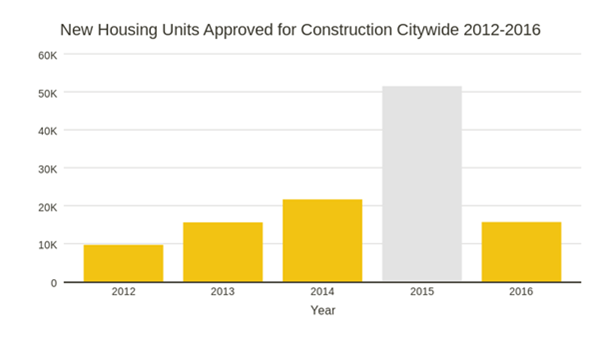

Last week, a data update released by the NYU Furman Center titled, “NYC New Building Permits Recovered to 2014 Levels in the Third Quarter [of 2016], Despite 421a Suspension,” notes that not only have the number of new construction permits returned to normal levels, but the number of units per building has also returned to normal levels – growing from an average of 26 units per building in the Bronx in the 1st quarter of 2016 to 39 units per building in the 3rd quarter. This suggests that the surge in new rental developments without 421a is not limited to small-scale, one-off development sites.

As ANHD’s previous blog examining 421a noted, “There is one thing the real estate lobby has asserted unequivocally [in order to justify the existence of the tax exemption]: ‘It was not feasible to build rental housing in New York City without the 421a subsidies.’… However, new trends suggest this may not be correct. In the past few months, there has been increasing evidence of new market-rate rental private construction in exactly the types of low-cost housing markets where the real estate lobby insisted would never happen.”

But new data indicates that new construction has adjusted to a housing market without 421a Trump Tax Break and is quickly recovering, and that the existence of 421a itself may have been hindering development in key markets. But new data indicates that new construction has adjusted to a housing market without 421a Trump Tax Break and is quickly recovering, and that the existence of 421a itself may have been hindering development in key markets.

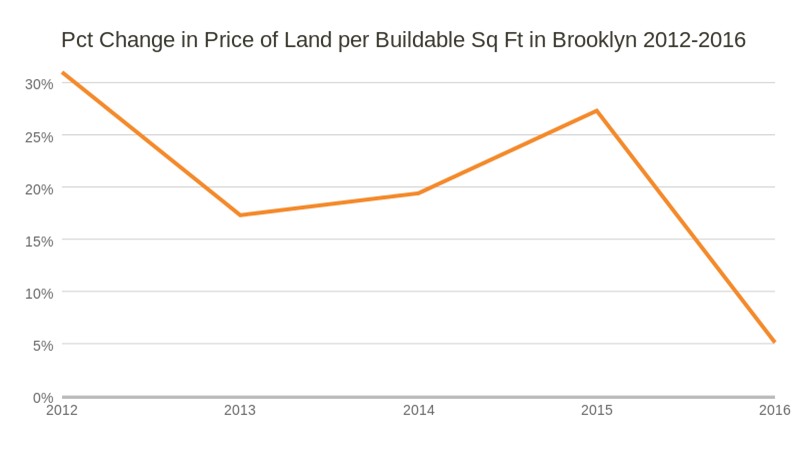

The general consensus of housing researchers and experts has been that the broad availability of the 421a Trump Tax Break has the effect of artificially inflating land prices, thereby increasing the cost of new housing development. One possible outcome of the suspension of 421a is that land prices in relatively weak real estate markets – where new privately-built housing will be more naturally affordable – would soften without the artificial stimulant of the tax exemption, with the effect of making new housing development in those neighborhoods more affordable.

This position was made in a 2015 NYU Furman Center report hypothesizing that “the loss of the 421a exemption would reduce the amount that residential developers would be willing to pay for the land.” The report continued, “In the medium and long term, as landowners adjust their expectations of the value of development parcels downward, or as market rents rise, the pace of development could resume.”

Further evidence from a New York City Development Update through the 2nd quarter of 2016, released by the investment firm NGKF Capital Markets, shows that the trend of increasing price per square foot for development sites in some key areas has slowed dramatically since 421a was suspended:

- In Manhattan above 96th Street, the average price per buildable square foot for development sites rose by 71% from 2014-2015, but only rose by 6% from 2015 through the first half of 2016.

- In the Bronx, the average price per buildable square foot for development sites rose by 24% from 2014-2015, but only rose by 2% from 2015 through the first half of 2016.

Together, this new data suggests that the suspension of 421a has softened land prices, which makes new development more economical even without 421a. The fact that new development is now more robust in these neighborhoods suggests that, as the return of 421a is debated, policy makers should examine what policy goal 421a actually accomplishes and whether the cost to the taxpayer is worth it.

Evidence is growing that we should be moving away from any 421a Trump Tax Break. Our City’s housing market is booming without it. Giving REBNY an unnecessary and unreasonably lucrative tax break at the expense of the tax paying public is unconscionable. Giving REBNY an unnecessary and unreasonably lucrative tax break at the expense of the tax paying public is unconscionable.

ANHD 2016 Building the Community Development Movement

ANHD 2016 Building the Community Development Movement