Bad Lending is as Destructive as Good Lending is Necessary

Part 3 of our 4 part series on our latest report, The State of Bank Reinvestment in New York City: 2016

This annual report helps communities, legislators, regulators, and the financial sector to better understand the impact of the Community Reinvestment Act (CRA) at a local level and how to better meet the needs of our city’s families and neighborhoods. The CRA is based on the understanding that quality intentional bank reinvestment is necessary to build and preserve affordable housing, provide access to safe affordable banking services, revitalize neighborhoods, and support quality jobs. ANHD’s report provides a unique analysis of the CRA activity of 25 banks that operate in New York City, including some of the largest banks in the country. This part focuses on Multifamily Lending and Community Development Loans & Investments.

MULTIFAMILY LENDING

New York is a city of renters – nearly two-thirds of New Yorkers rent their homes and the majority live in multifamily apartment buildings. Private rent-regulated housing remains one of the most important sources of private, more affordable housing in the City. New York City has over one million rent-regulated units, nearly half of all rental units, as compared to the 12.8% subsidized (public housing and other subsidies) units and 39% private un-regulated 20 units. Rent-regulated units are typically more affordable and provide more rights and protections for tenants than market rate units. Access to credit is critical to maintaining affordable rent-regulated housing in the City, especially in lower-income neighborhoods. Equally important to the volume of lending, if not more so, is that the loans are underwritten responsibly.

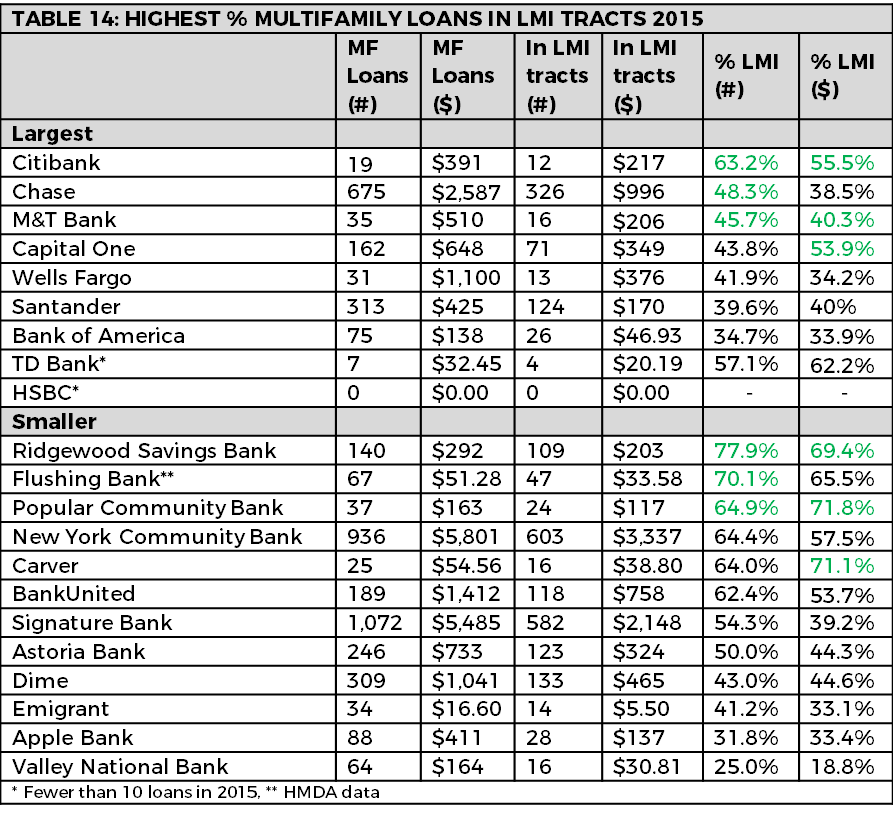

Multifamily housing lending is the only category of loan that is analyzed under two areas of the CRA. Regulators first look at the volume of loans inside and outside the assessment area and then the distribution of loans in low- to moderate-income census tracts. Because these are commercial loans, they do not look at the income of the borrower as they do for 1-4 family homes. Second, regulators evaluate loans that banks submit for community development credit. These are typically buildings, deed-restricted or not, where over 50% of the units are affordable to lower-income tenants, but they may also get CRA credit if the building is otherwise determined to contribute to neighborhood stabilization or provide another community service.

Speculative loans and loans to bad actor landlords open the door to a type of discrimination known as “predatory equity.” Unlike the practice of redlining that locked people of color out of the housing market, predatory equity investors make loans in communities of color, in low-income communities, and where low-income people live, but base those loans on highly speculative underwriting. Such loans have led to the widespread harassment and eviction of lower-income tenants. In fact, between 2003 and 2007, ANHD research found that private equity-backed developers purchased an estimated 100,000 units of affordable rent-regulated housing – nearly 10% of that housing stock. Since then, between 2007 and 2014, ANHD found that New York City lost over 156,000 rent-regulated units.

SOME TRENDS & FINDINGS

- The multifamily market remains strong, and the number of loans picked up again in 2015. And while signs of physical and financial distress remain low, rising rents and sales prices – especially in historically more affordable neighborhoods – increase the pressure on lower-income tenants, putting them at risk of displacement. Banks and non-bank lenders continue lending to known bad actor landlords, but not all of their buildings will appear on distressed lists. If a landlord successfully displaces tenants, the building may never fall into distress.

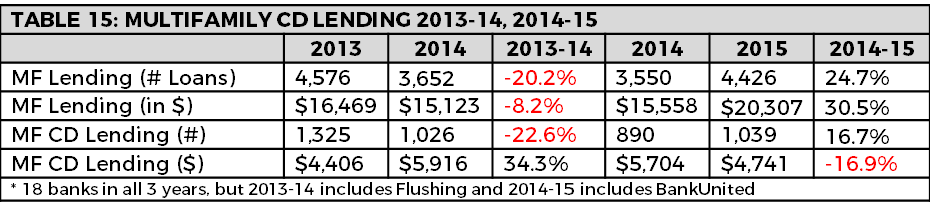

- The volume of multifamily lending that qualifies as a community development loan under the CRA increased 16.7% in 2015, but the dollar amount loaned decreased by about the same amount, indicating smaller loans on more buildings.

COMMUNITY DEVELOPMENT LOANS & INVESTMENTS

Community development loans and investments provide vital financing to build and preserve affordable housing, create jobs and economic development opportunities, and improve and revitalize City neighborhoods. New York City is on the forefront of affordable housing creation and preservation, with innovative programs and initiatives rarely seen elsewhere. This investment would not have been possible without the CRA, and will be more important than ever in the coming years. Community development under the CRA encompasses a wide but well-defined range of activities targeting low-and moderate-income people and communities to increase access to affordable housing, provide community services, promote economic development, revitalize or stabilize communities, and support certain foreclosure prevention activities.

CRA-qualified investments are lawful investments, deposits, or membership shares that have community development as their primary purpose. For example, banks may purchase mortgage government bonds or Low-Income Housing Tax Credits (LIHTC) or New Markets Tax Credits (NMTC) that fund affordable housing construction or rehabilitation and other larger scale developments. Investments also include community development grants, but given their small size relative to other investments and their importance to nonprofits, we examine those separately in our philanthropy section.

SOME TRENDS & FINDINGS

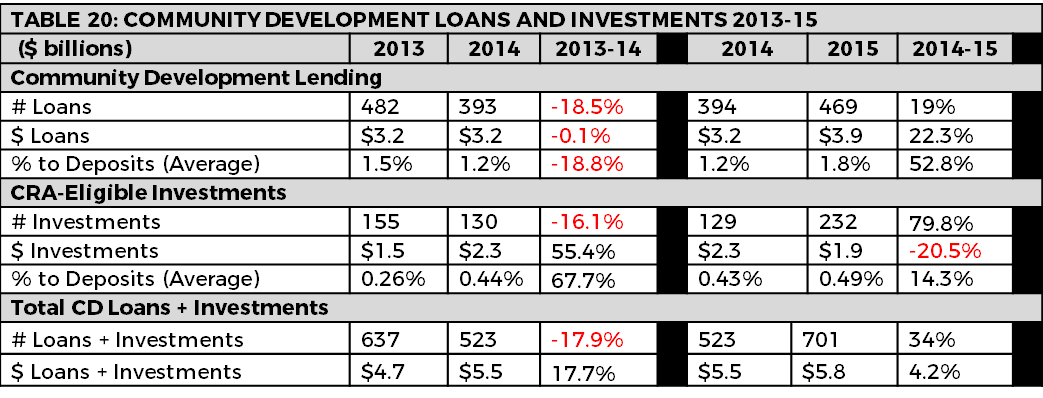

- Community development lending increased, but CRA-qualified investments decreased in 2015. $3.9 billion in Community Development Lending was made, averaging 1.6% local deposits. $1.9 billion in CRA-qualified investments was made, averaging 0.49% local deposits.

- Community development lending to nonprofits increased 12% by volume and 36% by dollar amount in 2015. In eight banks, over half of their community development loans were to nonprofits by volume. In six banks, over half of the community development dollars loaned was to nonprofits as well. Investments in nonprofits more than doubled by volume and tripled by dollar amount. We are encouraged to see lending to nonprofits specifically for affordable housing also increased in 2015.

- All but three banks maintained or increased their community development staff serving New York City and being located in New York City.

SOME OF OUR RECOMMENDATIONS

CRA-covered banks must meet credit needs that enable healthy multifamily lending in low- and moderate-income neighborhoods. Banks should strive for the majority of their multifamily lending to be in low- to moderate-income neighborhoods.

CRA-covered banks should increase the volume of multifamily lending that qualifies as community development loans under the CRA. Community development loans in this context include responsible mortgages on affordable rent-regulated buildings, project-based Section 8 buildings, and other affordable housing projects.

Banks should commit to best practices in multifamily lending. See page 51 of the report for a summary of these best practices.

Regulators must hold banks accountable for financing bad actor landlords. The New York State Department of Financial Services (DFS) took an important step in declaring that loans that result in a loss of affordable housing or poor conditions will not get community development credit on CRA exams41. The FDIC and the Federal Reserve have been following similar practices. We urge the OCC to follow suit and for all regulators to make it as publicly known as DFS.

Banks should continue to increase community development loans and investments. They should also direct resources to nonprofit and community organizations that are locally rooted and committed to permanent affordability and long-term improvements in their communities.

Banks should support the smaller and most effective nonprofit developers with targeted affordable products to build and preserve affordable housing and create quality jobs.

Banks and regulators must look at the overall impact of the activity with respect to the quality of jobs created, the quality of housing, and the sustainability of the impact over time. They must ensure that the loan meets the needs of local communities and does not cause harm.

Banks should have a strong community development team with a presence in New York City.

ANHD 2016 Building the Community Development Movement

ANHD 2016 Building the Community Development Movement