Banking deserts and disparities in home lending persist

Part 2 of our 4 part series on our latest report, The State of Bank Reinvestment in New York City: 2016

This annual report helps communities, legislators, regulators, and the financial sector to better understand the impact of the Community Reinvestment Act (CRA) at a local level and how to better meet the needs of our city’s families and neighborhoods. The CRA is based on the understanding that quality intentional bank reinvestment is necessary to build and preserve affordable housing, provide access to safe affordable banking services, revitalize neighborhoods, and support quality jobs. ANHD’s report provides a unique analysis of the CRA activity of 25 banks that operate in New York City, including some of the largest banks in the country. This part focuses on Branches and Banking Products; and 1-4 Family Lending.

BRANCHES & BANKING PRODUCTS

When the CRA was first written in 1977, many banks refused to open branches and invest deposits in low-income communities and neighborhoods of color. Community groups have fought long and hard over the years to simply get banks to open branches in underserved neighborhoods. Forty years later, we still struggle to get banks to open – and not close – branches in unbanked and underbanked areas, but access to banking has become more complex. New Yorkers today face additional barriers to banking due to issues of cost and identification.

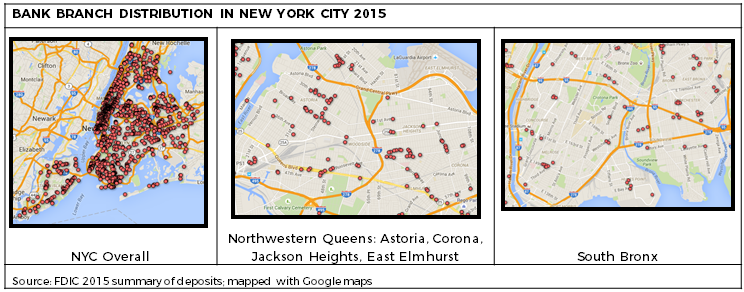

The vast majority of bank branches in New York City are in Manhattan below 96th Street. In the rest of the City, they are sparser and tend to be clustered along commercial corridors, leaving low-income communities of color with very few options. Access to banking and credit is more complicated as banks are closing branches and expanding mobile and online options. Branches remain important and low-income, immigrant New Yorkers need access to affordable, accessible accounts and products.

1-4 FAMILY LENDING

As much as New York City is a city of renters, nearly a third of New Yorkers own their own homes, a rate that has not moved much since 2005. Homeownership is an important source of housing and asset-building for many New Yorkers. At the same time, small 2-4 family homes can also be both a source of income for the homeowner and a potential source of affordable housing for renters. The City and financial institutions, especially those covered by the CRA, have an obligation to ensure that this opportunity of homeownership is made equitably to lower-income and minority people and communities throughout the City.

1-4 family lending is at the core of the CRA. As part of the CRA lending test, banks are evaluated on the volume of their 1-4 family home lending inside and outside their assessment areas and the percentages of loans to low- to moderate-income people and in low- to moderate-income geographies. Under the CRA, loans the bank originates are treated the same as loans they purchase from another institution. ANHD believes that originated loans are much more impactful in directly reaching current and potential homeowners.

SOME TRENDS & FINDINGS

- Branches in low- to moderate-income tracts remained stagnant and banking deserts persist.

Branches are not distributed equitably, with the majority concentrated in mid- and lower Manhattan below 96th Street and much fewer in upper Manhattan and the outer boroughs. The Bronx and Brooklyn have nearly 50% of the City’s population, yet only 30% of the branches, and especially with so many concentrated in a few commercial corridors, many neighborhoods have none at all.

- More banks are offering affordable bank accounts, but more needs to be done.

We are pleased that many of the smaller banks and some larger banks now offer checking accounts with low or no maintenance fees, and some of the largest banks offer “checkless checking accounts” that do not allow overdrafts. However, we also found that some of these same banks are taking in tens of millions of dollars in overdraft fees; Bank of America, Chase, and Wells Fargo each took in over $1.6 billion in overdraft fees 2015. Immigrants continue to face barriers to opening accounts, often due to a lack of identification. Among banks in this study, only Carver Bank now accepts the IDNYC as primary ID (a total of 13 banks and credit unions in NYC accept it as primary)

- Home lending is up, but the percentage of loans to lower-income borrowers remains stagnant. Racial disparities persist.

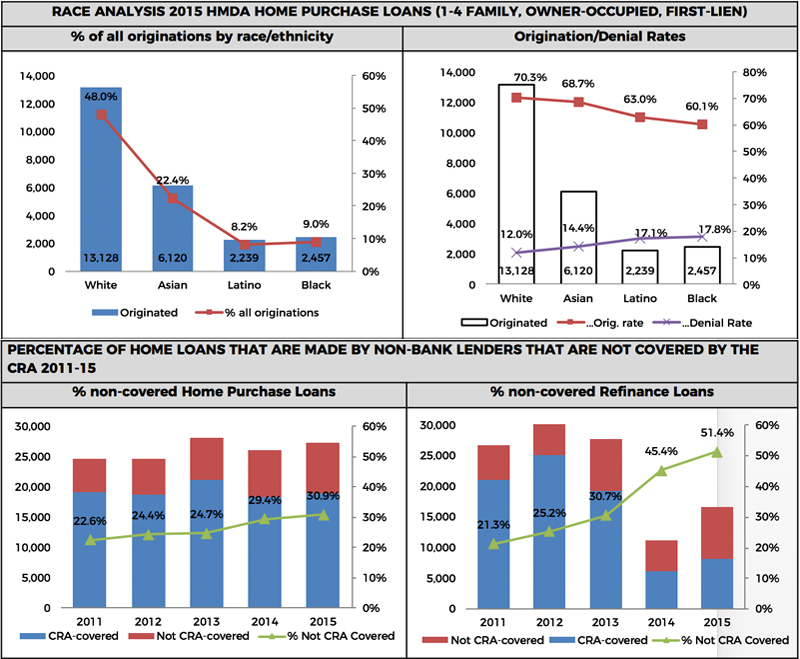

Citywide, while the number of home purchase loans overall were up 10.7% from 2012 to 2015, the number to low-to moderate-income borrowers stayed virtually the same: 2,307 in 2012 and 2,310 in 2015. Among the 21 retail banks in this study, the number of loans dropped in that same time period; down 5% overall and 8.4% to LMI borrowers. This reflects the decline of lending by the “Big Four” lenders. 22% of New Yorkers are Black and 29% Latino, yet in 2015, only 9% of home purchase loans in New York City went to non-Hispanic Black borrowers and 8.2% went to Latino borrowers of any race. We also note that FHA loans make up a higher percentage of loans to Black and Latino borrowers.

- CRA lending programs are critical.

More banks are offering and refining their CRA products, either through portfolio products or participation in government programs like SONYMA, FHA and Fannie Mae. But, given the drop in lending overall and by CRA-covered lenders, more is needed to ensure the products are being used by the populations who need them most.

- The percentage of non-CRA covered lenders is rising.

In 2012, 24.4% of all home purchase loans were originated by non-CRA covered lenders and that increased to almost a third at 31% in 2015. 51.4% of 2015 refinance loans were originated by non- CRA covered lenders, up from 25.2% in 2012. The percentage of FHA loans made by non-CRA covered lenders is much higher. In 2015, 79% of FHA home purchase loans and 94% of FHA refinance loans were made by non-CRA covered lenders.

SOME OF OUR RECOMMENDATIONS

Banks should open and maintain branches in underserved areas. 25% of a bank’s branches should be in low- and moderate-income tracts and 10% in low-income tracts in particular.

Every bank should offer safe, affordable bank accounts, and banks should accept alternate forms of identification in addition to a social security card to open an account. All banks should accept the IDNYC as primary identification.

Banks should offer branch products and implement practices to serve lower-income and immigrant communities by partnering with the City and nonprofits that provide high-quality financial counseling and education related to all aspects of banking and access to credit, and providing services to non-native speakers with staff, materials, and products that reflect the local languages and cultures.

Increase home purchase lending, particularly to lower-income people and neighborhoods, immigrants, and borrowers of color.

Create products and dedicate staff specifically for lower-income borrowers, immigrants, and borrowers of color with low down-payment requirements, reasonable credit assessments that allow for alternative forms of credit, down payment assistance, and connections to homebuyer counseling. Affirmatively market these products to targeted communities and organizations serving those communities.

Banks should offer affordable home improvement loans and participate in government programs to assist lower-income homeowners, such as the City’s Home Improvement Program (HIP) offered through New York City Housing Preservation and Development (HPD).

Prevent and responsibly deal with foreclosed homes: Grant more trial and permanent modifications, maintain in good condition homes taken by foreclosure, and reduce the delays for homeowners due to lost paperwork, staff changes, and untimely responses.

ANHD 2016 Building the Community Development Movement

ANHD 2016 Building the Community Development Movement