DEPOSITS AND REINVESTMENT QUANTITY INDEX & QUALITY SCORE

The basic principle of the CRA is that if a bank takes deposits or does business in a neighborhood, it must provide all of its services equitably. This comes with a continuing and affirmative obligation to help meet the credit needs of low- and moderate-income neighborhoods in particular. While nowhere near perfect, the CRA is still one of the most effective tools we have to bring banks to the table to invest in low- and moderate-income communities through loans, investments, and services.

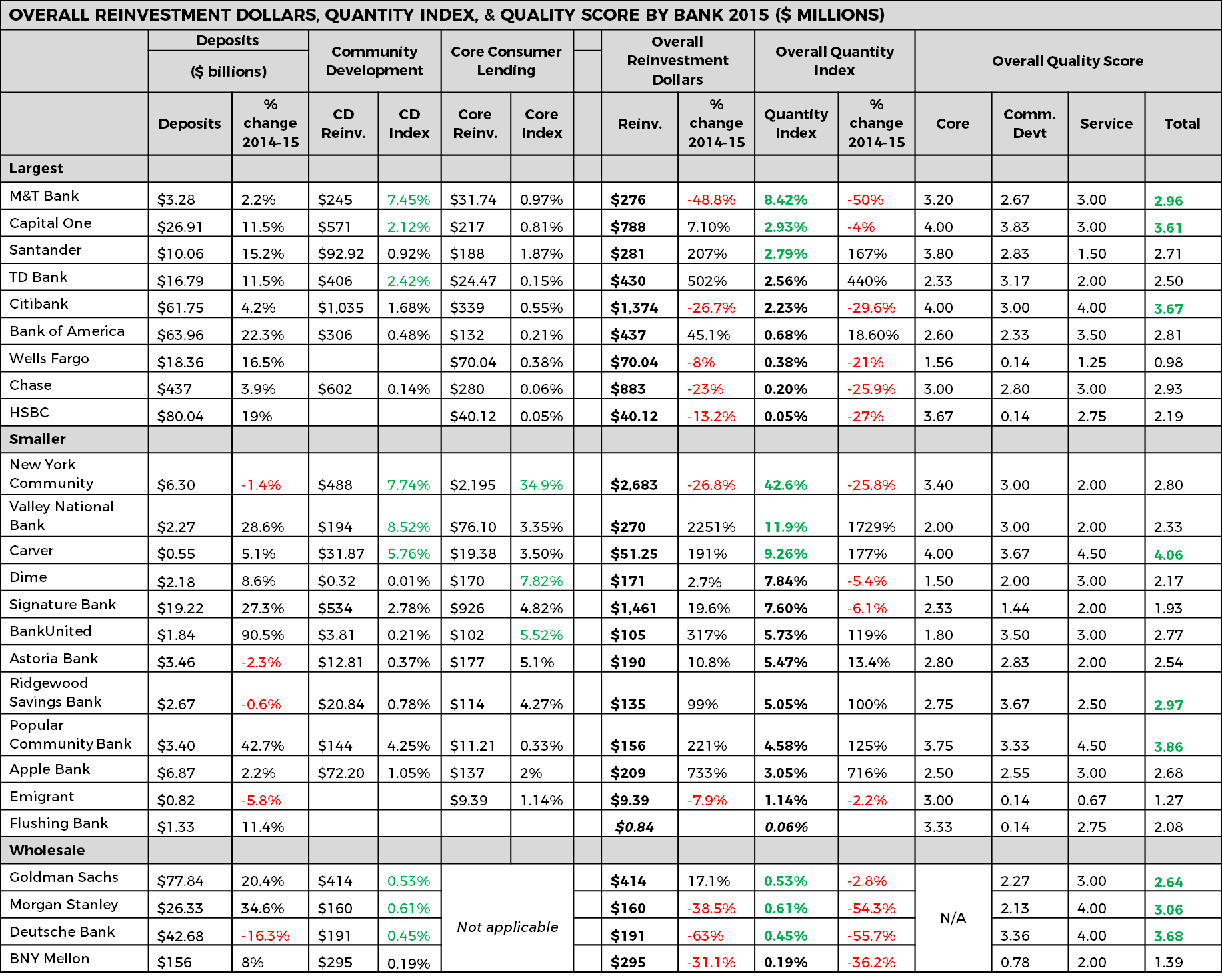

The quality of this reinvestment matters just as much as quantity, and this report goes to great lengths to measure both. Rather than create one overall ranking, we developed a QUANTITY Index to assess the banks’ volume of reinvestment dollars loaned and invested and a QUALITY Score to compare the quality of that lending based on factors we believe indicate a strong commitment to local communities.

Of course, no single tool can capture every aspect of good community development, which is why we hope this more nuanced metric provides a useful tool to highlight areas where banks do well and areas they could improve. This enables us to evaluate banks individually and compare them to each other while still allowing for the CRA’s flexibility in the specific loans, investments, and services each bank provides.

SOME TRENDS & FINDINGS

- Deposits increased 8.2% in 2015 overall and 7.2% outside of Manhattan.

- Reinvestment dollars declined 8.5% in 2015: Core Consumer & Commercial Reinvestment decreased 19% while Community Development Reinvestment increased 3.7%.

- Quality Score: 6 banks scored over 3, down from 8 in 2014.

SOME OF OUR RECOMMENDATIONS

All banks should commit to reinvesting 5% or more of local deposits dedicated to the full range of targeted, strategic reinvestment lending and investments that specifically benefit low- and moderate-income communities.

Banks should strive for a quality score above “3”, indicating they beat their peers in more areas than they lagged with regards to the percentage of activities that have the biggest impact. This represents a commitment to fair lending and to factors that have an impact beyond simply the dollar amount.

ANHD 2016 Building the Community Development Movement

ANHD 2016 Building the Community Development Movement