Black and Latino Borrowers Locked Out of Homeownership in New York City, New Data and Analysis Shows

A new analysis by the Association for Neighborhood & Housing Development (ANHD) of lending data released last month under the federal Home Mortgage Disclosure Act (HMDA) sheds light on the overall state of the home mortgage market in New York City. The analysis reveals troubling findings, including:

- People of color – particularly Black and Latino – and low- and moderate-income people are being locked out of homeownership in New York City.

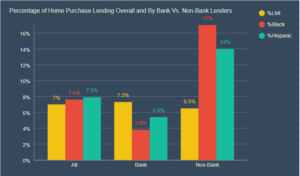

- Racial disparities in lending persist, and are getting worse – 22% of New York City’s population is Black and 29% is Hispanic, yet fewer than 7.6% of all loans went to Black borrowers and 7.9% to Hispanic- a lower rate for both from the prior four years.

- Non-bank lenders are increasing their presence overall, and particularly to borrowers of color and in neighborhoods of color, while banks are retreating from lending to and in those communities, placing these communities at a greater risk of paying higher costs and making them vulnerable to risky behavior (as non-bank lenders have fewer oversights than CRA-regulated banks).

The 2017 HMDA data analyzed by ANHD reveals the continuation of troubling trends noted in prior white papers. Fair lending laws and the Community Reinvestment Act (CRA), were passed over 40 years ago to address the practice of redlining and disinvestment by both government and financial institutions. HMDA was created soon after in order to enforce fair lending laws and help fight against the systematic denial of access for people of color to homeownership and banking.

The 2017 HMDA data analyzed by ANHD reveals the continuation of troubling trends noted in prior white papers. Fair lending laws and the Community Reinvestment Act (CRA), were passed over 40 years ago to address the practice of redlining and disinvestment by both government and financial institutions. HMDA was created soon after in order to enforce fair lending laws and help fight against the systematic denial of access for people of color to homeownership and banking.

HMDA data is a key part of a bank’s evaluation under the CRA and focuses on their percentage of loans to low- and moderate-income (LMI) borrowers and in LMI census tracts. As regulators consider the biggest overhaul of the CRA in 20 years, we urge them to remember that the CRA should never have been colorblind. The CRA should be expanded to have an affirmative obligation to meet the credit needs of people and communities of color.

The paper lays out more details on these trends and a full set of recommendations. Click here to download the report.

Jaime Weisberg, ANHD’s Senior Campaign Analyst

ANHD 2016 Building the Community Development Movement

ANHD 2016 Building the Community Development Movement