What are the Trends and Best Practices in Bank Philanthropy?

Part 4 of our 4 part series on our latest report, The State of Bank Reinvestment in New York City: 2016

This annual report helps communities, legislators, regulators, and the financial sector to better understand the impact of the Community Reinvestment Act (CRA) at a local level and how to better meet the needs of our city’s families and neighborhoods. The CRA is based on the understanding that quality intentional bank reinvestment is necessary to build and preserve affordable housing, provide access to safe affordable banking services, revitalize neighborhoods, and support quality jobs. ANHD’s report provides a unique analysis of the CRA activity of 25 banks that operate in New York City, including some of the largest banks in the country. This part focuses on Philanthropy & CRA-Eligible Grants.

PHILANTHROPY/CRA-ELIGIBLE GRANTS

CRA-eligible grants are technically considered “investments” under the Community Reinvestment Act and are evaluated under the investment test. However, because of their small size relative to other larger investments, such as tax credits and bond purchases – and their importance to the nonprofit sector – we analyze them separately in this report.

Banks and their foundations support a wide variety of organizations – including schools, arts and culture, and affordable housing – to name a few. CRA-eligible grants must support community development as defined by the CRA to increase access to affordable housing, provide community services, promote economic development, revitalize or stabilize communities, and support certain foreclosure prevention activities.

SOME TRENDS & FINDINGS

- CRA-eligible grants decreased in 2015 while the number of grants increased. The distribution is unequal, resulting in larger grants to fewer organizations in some of the larger banks.

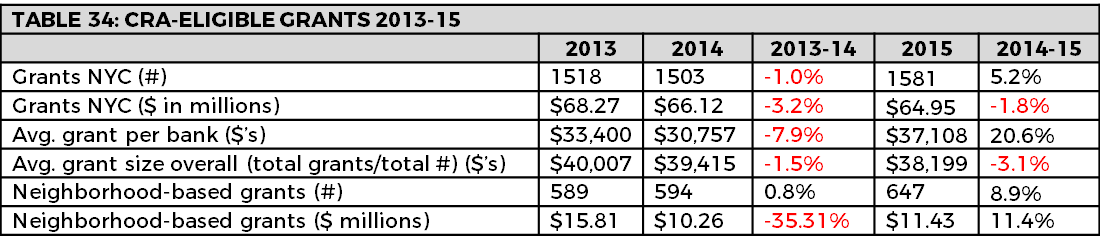

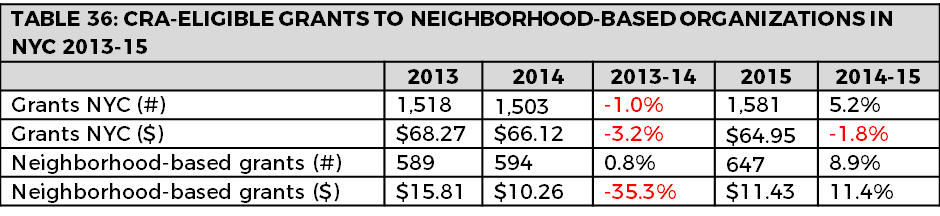

CRA-eligible grant dollars decreased another 1.8%, down $1.17 million, following a 3.2% decline, down $2.15 million, among the 19 banks for which we have data in 2013, 2014, and 2015. Most banks continue to dedicate less than one tenth of one percent of their local deposits to grants. Banks that take CRA most seriously dedicate closer to 0.025%-0.033% of local deposits to CRA-eligible philanthropy.

ANHD members have noted over the past few years that banks seem to be changing their grantmaking strategies and that fewer grants are going to larger organizations. These trends appear reflected in the data. While grant dollars decreased, the total number of grants increased, indicating a larger number of smaller grants. However, among some of the larger banks that give more total dollars, the opposite is true. When we look at the average grant size per bank, the average amount giving increased from $30,757 in 2014 to $37,108 in 2015. It was at $33,400 in 2012. The increase is most pronounced in the largest retail banks, going from $34,893 in 2013 to $47,362 in 2014 to $62,253 in 2015.

- Grantmaking increased to neighborhood-based organizations

We are pleased to see the number and dollar amount of grants to neighborhood-based organizations increase in 2015 among the 15 banks that provide this data. This increase follows a sharp decline in dollars in 2014. Neighborhood-based organizations are locally based, many of which work on the ground to empower their communities and improve their neighborhoods. Giving directly to neighborhood-based organizations demonstrates an intentional commitment to New York City neighborhoods. ANHD members often are looking for funds to further their missions. This encompasses the wide range of community development activities, including but not limited to financial literacy, workforce development, pre-development and acquisition costs, grants to CDFIs to complement loans and investments, and community organizing.

- More banks are adopting best practices for community development grantmaking.

Community development grantmaking is about the dollars invested and the intentionality behind those dollars. Grant dollars are much smaller than other CRA-qualified investments and loans, but their impact can be profound when deployed in a thoughtful manner. A few banks stand out as collaborating with the nonprofit sector in identifying priorities and creating programs. And more banks are adopting best practices for grant making (see recommendations below).

SOME OF OUR RECOMMENDATIONS

- Sustain or increase grantmaking each year.

- Dedicate at least 50% of grants towards neighborhood-based organizations.

- Adopt best practices for effective, impactful community development grantmaking:

- Work closely with the nonprofit sector.

- Be accessible through a transparent RFP process.

- Be highly intentional, with a specific theory and goal underlying the grantmaking.

Nonprofit community development organizations, including community development corporations (CDCs), work on the ground to respond to the needs of the low-income, immigrant, and minority communities in which they work. The groups with which we work are mission-driven to serve these communities across the community development spectrum, including building and preserving affordable housing, creating and preserving quality jobs, and increasing access to credit and banking. Many do all of this and more.

These organizations support their missions from multiple sources, including government sources, fees for services, and individual donations or membership dues. However, most rely upon grants for a significant percentage of their funding. This may include grants from government entities, private foundations, or corporations such as banks. CRA-eligible grantmaking is a critical source of funding for many community development organizations.

ANHD 2016 Building the Community Development Movement

ANHD 2016 Building the Community Development Movement